The Main Principles Of Second Mortgage

Table of ContentsSecond Mortgage Things To Know Before You BuyThe 5-Minute Rule for Second MortgageNot known Details About Second Mortgage The 20-Second Trick For Second Mortgage

Bank loan rates are likely to be more than key mortgage prices. In late November 2023,, the current typical 30-year set home loan rate of interest rate was 7.81 percent, vs. 8.95 percent for the ordinary home equity funding and 10.02 percent for the ordinary HELOC. The variation schedules partly to the loans' terms (2nd mortgages' settlement durations often tend to be much shorter, usually 20 years), and partially because of the lending institution's danger: Ought to your home fall under repossession, the loan provider with the bank loan car loan will certainly be 2nd in line to be paid.

You after that obtain the distinction between the existing mortgage and the brand-new home loan in a single lump sum. This option may be best for somebody who has a high rate of interest on a first home loan and intends to benefit from a decrease in prices ever since. Home mortgage rates have increased sharply in 2022 and have actually continued to be elevated because, making a cash-out re-finance less attractive to lots of house owners.

Bank loans give you access to cash as much as 80% of your home's worth in some situations however they can likewise cost you your home. A second home loan is a finance gotten on a residential property that already has a home mortgage. A second home mortgage offers Canadian homeowners a means to transform equity right into cash money, but it additionally suggests paying back two financings concurrently and possibly losing your home if you can not.

Second Mortgage Things To Know Before You Buy

:max_bytes(150000):strip_icc()/2-1_buydown.asp-final-d03c18fb13aa44669cb2c713a3733844.png)

They might include: Management fees. Evaluation fees. Title search charges. Title insurance coverage costs. Legal charges. Interest rates for bank loans are often more than your existing mortgage. Home equity funding interest rates can be either dealt with or variable. HELOC rates are constantly variable. The added mortgage lending institution takes the 2nd position on the residential or commercial property's title.

Generally, the higher your credit scores score, the better the car loan terms you'll be provided. If you're in requirement of cash and can afford the added costs, a 2nd home mortgage might be the best action.

When purchasing a second home, each home has its very own home loan. If you buy a 2nd home or investment residential or commercial property, you'll have to use for a new mortgage one that just applies to the brand-new residential or commercial property.

Little Known Questions About Second Mortgage.

A home loan is a car loan that uses actual home as collateral. With this wide interpretation, home equity car loans include domestic first home loans, home equity lines of credit scores (HELOC) and second mortgages.

While HELOCs have variable passion prices that transform useful source with the prime price, home equity fundings can have either a variable rate or a fixed price. You can obtain up to a combined 80% of the value of your home with your existing home mortgage, HELOC and a home equity loan if you are obtaining from a financial establishment.

As an outcome, exclusive home mortgage lenders are not restricted in the amount they can loan. The greater your combined lending to worth (CLTV) ends up being, the greater your rate of interest prices and charges become.

The Main Principles Of Second Mortgage

Hence, your current mortgage is not influenced by obtaining a second home mortgage considering that your primary mortgage is still very first in line. Therefore, you could not re-finance your mortgage unless your 2nd home loan lender concurs to sign a subservience contract, which would bring your major home click this loan back to the elderly placement (Second Mortgage).

If the court concurs, the title would move to the elderly lender, and junior lien holders would simply end up being unsecured financial institutions. However, an elderly lender would certainly ask for and receive a sale order. With a sale order, they have to market the home and use the earnings to please all lien holders in order of ranking.

Therefore, second home loans are much riskier for a lender, and they demand a greater rates of interest to change click to read more for this included risk. There's likewise an optimum limit to exactly how much you can borrow that takes into consideration all home mortgages and HELOCs safeguarded against the building. For example, you won't have the ability to re-borrow an additional 100% of the value of your home with a bank loan in addition to an already existing home loan.

Marques Houston Then & Now!

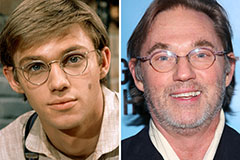

Marques Houston Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!